05 Dec HARSEST – B2B and B2C in Fashion Business

1. Retailing Channel

2. The Concept of B2B and B2C

3. The Pricing structure of B2B and B2C

4. Case Study

Aside from the business itself, sales are the most important aspect of the fashion business. Traditional channels for the fashion industry are online sales, brick and mortar retail stores, catalogs, mail orders, pop-up shops, flash sales etc. In other industries, there are B2G and B2B2C, which use a hybrid sales structure, while the fashion business is mostly held through B2B and B2C. This report deals with definitions of the retailing channel, B2B, and B2C. It also gives suggestions to find a suitable channel and how to apply the pricing structure using B2B and B2C. The case study explores the margin structure of overseas sales in the fashion business.

1. Retailing Channel

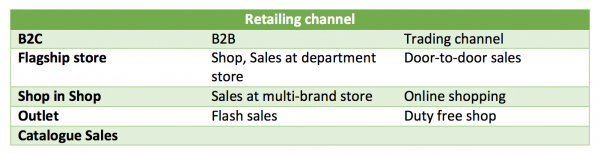

Fashion businesses must pursue profits in order to grow through sales. Sales is the channel that involves brand strategy on where and how to sell the product. There are three main types of channels: Business to Business (B2B), where the brand utilizes a wholesale business through a shop or department store, Business to Customer (B2C), where the brand directly sells the product to the customer, and transactional channels such as e-commerce and duty-free stores in the airport.

There is a wholesale trade (B2B) at trade fairs and conventions, which traditionally started from the European fashion industry. Most luxury brands have transformed from B2B to B2C. This is because the B2C channel has a bigger profit margin with direct feedback from customers to enhance the sales process. It is more difficult to control brand image in B2B whereas the B2C channel can form many sales strategies.

For instance, there are differences between going to ABC Mart and purchasing NIKE products (B2B) and purchasing NIKE products at a NIKE store. Most of the European luxury brands use the B2C channel such as a flagship store to serve customers directly. New retail concepts are introduced in traditional methods of B2B and B2C, which are shown in the chart below:

A. Fast Fashion Retailer

Fast fashion retailer is the concept that brought about the most significant change in the fashion business B2C (e.g., Zara, H&M). These brands manufacture products in a developing country (Produced in Eastern Europe, Spain, and Portugal, depending on the item) and maximize the profit margin by enabling better logistics management. The lead time (the period of time between the initiation and completion of a production process) of these brands are generally much shorter compared to other brands and they are fully systemic as an IT company.

B. Online Shopping

Ironically, online shopping began with the development of porn sites in the mid-1990s. With the opening of the era of online card payments, most businesses began to sell online. Brands were able to create their own website and sell their products directly (B2C). The price was made similar to the wholesale price through stock clearance companies such as Gilt, Modnique, Reebonz, Century21, etc. According to a report by McKinsey, 4% of luxury brand sales in 2012 were made online, which would increase to 6% by 2017, and 25% of the stores suffered greatly by online shopping.

C. Shop in Shop

Shop in the shop is the concept of renting a given space (e.g., shopping malls) or selling it directly after entering accordingly to the transaction conditions.

D. Multi-Brand Store

The multi-brand store is a retail concept, in which multiple brands are introduced together in one place. Sales through a multi-brand store are advantageous for brands by having positive marketing effect. Since the order volume is smaller, this platform is used as a marketing strategy to sell products in bigger stores rather than to gain profit from sales. For example, the famous French store Colette has an ordering pattern of 10 items. Retail stores such as ABC Mart and Intersport that sells a product with a single segment are increasing. Opening Ceremony bought many brands and started retailing (B2B) and also created their own private brand and sold directly to consumers (B2C).

2.The Concept of B2B and B2C

A. B2B

A. B2B

B2B channel in the fashion business has a pre-order period which creates stable cash flow by displaying products for the next season to buyers. The brand must prepare a certain amount of products, while also preparing for any losses that they may incur (defective products, lost on delivery, samples, etc.) The annual timeline for the brand is one and a half years ahead of the retailing season.

For example, if it is March 2016 (retailing season SS16), the design team is designing products, holding meetings with consultants for trendy colors, or participating in textile fair to select fabric for AW17. The company is already considering fabrics for fall 2017 and designing products to launch in January 2017 as early as March 2016. The sales team will be receiving orders from overseas buyers and sending orders to manufacturers for the AW16 items that were presented in January. They will also be delivering products for SS16 as well as analyzing reactions from the market to estimate the target for the next season.

There may be a form of B2B channel that does not receive any pre-orders, especially small and medium-sized companies for domestic sales through their website (B2C) on a contingent basis. While it is hard to predict cash flow, it may have the advantage of being able to meet demand through flexible reproduction through the observation of sales trends. However, the company may face some difficulties if there is leftover stock in the offseason.

The most important aspects for fashion businesses using the B2B model are maintaining close relationships with buyers as well as knowing how to make seasonal items appealing. For large department stores, buyers are divided into men’s and women’s clothing sections, and there are usually Assistant Buyer, Junior Buyer and Senior Buyer in each section. The Senior Buyer has the final decision even though a brand maintains a good relationship with the Junior Buyer. Therefore, consider promotion, turnover and personal business to form a good relationship from the onset. On the other hand, the manager is mostly a buyer in the store with one shop; therefore, they will keep purchasing from the brand if the previous season’s sales were stable. Even though it is difficult to initiate the first transaction with a large company such as a department store, they will continue purchasing for at least two or three seasons due to the financial stability, while smaller stores have other variables to consider and might terminate the transaction in the first season.

B2B channels mostly depend on the capability of sales managers compared to B2C. The sales manager must be successful in sales for the brand and helpful to buyers. In many cases, newly opened shops face some challenges during the first transaction such as FTA, logistics, invoice, price settlement, etc. The sales manager may aid in forming a good relationship in order to start transactions. As the shops grow, those brands will become loyal buyers since they will come to appreciate the help from the sales manager. The sales manager must be bright, responsible, well prepared and have an exceptional understanding of the brand. Even the CEO of Ralph Lauren started his career in sales with Brooks Brothers.

B2B channels have the advantage of having a higher minimum order quantity (MOQ) compared to B2C. It is possible to predict and prepare for the next season with pre-orders. Marketing is less important for B2B channels. It can also have a simpler company structure which is better for overseas sales. On the other hand, the profit margin is smaller. Although the comparison between the manufacturing cost, wholesale, and retail price is different, the profit margin is certainly smaller compared with B2C. It is more difficult to create sales in comparison to B2C and can take more time for the buyers to make a purchase since they decide based on rational decision making.

In addition, there is less feedback a brand can receive because the brand cannot directly communicate with the end customer who uses the product, and there is a limitation in controlling the brand image.

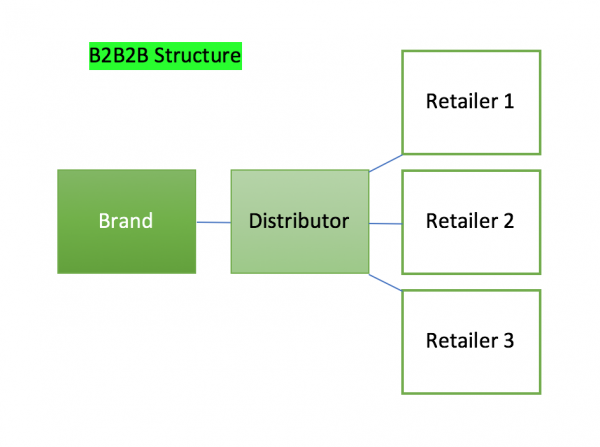

*NOTE: There is also a B2B2B channel in the fashion business which starts from brand to distributor to retailer. This is when the brand enters into a contract with a distributor for official rights to one country and the distributor resells to the retailer within the country.

B. B2C

B. B2C

B2C is a channel in which the brand creates sales directly to customers such as flagship stores, shop in shop, outlets, and online shopping malls. It is possible to produce trendy products; however, it is mostly commercial products for profit compared to the B2B designer “submitting” the product in the market. This is especially the case for small and medium-sized brands. Marketing is most important for B2C as this is what exposes the brand or product to the public.

Since B2C targets more on a comprehensive scale than B2B channel, effectiveness cannot be underestimated. At many times, more is spent on marketing for a bigger impact on the market through the use of celebrities. Generally, in the fashion industry, the 10% of promotional expenses are used by the B2B brands as it is 30% with B2C brands. Guthy-Renker, a representative of Proactiv, mentioned that a B2C Cosmetics Company in the United States takes one and a half year to surpass the breakeven point with invested money in marketing. Even though cosmetics companies need to invest more in marketing to create loyal customers, it shows how important marketing is in B2C.

The biggest advantage of B2C is the larger profit margin compared to B2B. When the B2C brand becomes an expensive brand with a good amount of exposure and a positive image, they are able to create more profit margin than B2B. Even when inventory goes to outlets and sells at a 70% discount, it still exceeds production costs, such as luxury brands. Since the sales channel takes place within the brand, it is possible to form a closer relationship with customers and get direct feedback to create a suitable brand image according to the trends. B2C has faster cycles than B2B in sales, as customer purchases are mainly based on emotional decisions.

On the other hand, B2C brands need more employees and the initial cost of opening a store is higher. In addition, it has limits in expanding to overseas markets because of its pricing structure and regional limitations. It has regional limitations in choosing the location of shops as they are forced to open a flagship store in a big city. For example, in a capital city, it is better to open a flagship store on an open street as a marketing tool. Open up a street shop in another major city with 16% of a trendsetter in the capital city; 68% of the purchase is held in the other major cities while as the third city is consumed as a sensible layer of living in need of trend-unrelated clothing by opening up an outlet.

3.The Pricing structure of B2B and B2C

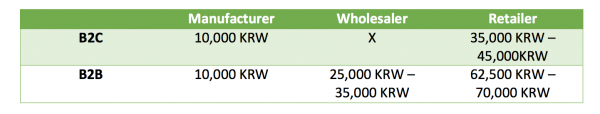

Consider pricing structure, for example, pricing in terms of profit margins where the aforementioned differences in B2B and B2C were evident. The bigger the brand, the lower the production cost, thus the profit margin may vary slightly depending on the size of the brand. While B2C has a simple pricing structure, B2B offers various complex elements in overseas sales. Practical examples of how the pricing structure of the brand changes when exported are shown below.

B2C

Production cost: 10,000 won

The retail price: ranges from 35,000 won to 45,000 won

The products are sold at 3.5 to 4.5 times the production cost (10,000 won) for on/offline stores. Consignment sales are sold at 2.27 to 2.9 times with 35% commission fees.

B2B

Production cost: 10,000 won

The wholesale price: ranges from 25,000 won to 35,000 won

The retail price: ranges from 62,500 won to 70,000 won

The products are sold at 25,000 to 35,000 won with a production cost of 10,000 won in on/offline stores with wholesale price. Store owners sell purchased items at retail prices between 62,500 and 70,000 won, leaving them with a double to 2.5 times profit margin.

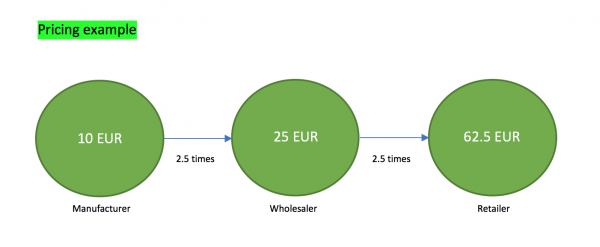

To find out the conditions for exporting from B2B by simplifying the price, wholesale and retail prices are at 2.5 times as shown below:

The two conditions under which Korean brands can benefit from foreign distribution are the trading terms (included in Conditions and Terms provided by a brand) on delivery and benefits from FTA on the tariff.

A. International Commercial Terms (Incoterms): FOB, EX-Work, CIF, DDP, FCA

The most commonly used terms are mentioned above. FOB is when a brand ships the product to the shipping dock on distributor’s selection. The retailer is responsible for picking up the item from the port. Ex-work is when the person who picks up the product from the brand’s warehouse or office takes responsibility for their shop or warehouse. CIF Is insurance on the item while as FCA is similar to FOB, as it is used to pick up the products by air rather than ship. Delivery duty paid (DDP) is without a hidden fee which indicates the cost for shipping and tariffs. These terms are important since Ex-work costs more than FOB in terms of tariffs when it is settled in Korea. Brand prefers FOB while the company that picks up the product prefers Ex-work.

Each exporting country has different tax and tariff structures. The following are tariff and tax structures for imported goods:

Taxation calculation formula: [Total purchase amount (commodity price + shipping fee + tax) x exchange rate (tax notice rate on the date of arriving in Korea) + tax rate by weight

Tariff: Tax amount * % of tariff on the product / VAT on items: (Tax amount + Tariff amount) * 10 %

B. Free Trade Agreement (FTA)

An FTA is originally a treaty between newly-developed countries or countries with no tariffs for trade with other countries. For example, Korea and India have entered into an agreement with many countries while Japan only has a few. Korea is a suitable country to export in many ways. Currently, there is an agreement between the United States, 28 countries in Europe, and Turkey (Korea also benefits from the gradual partial abolishment of the FTA between Turkey and Europe), Chile, the ASEAN FTA and India has been established with the Comprehensive Economic Partnership Agreement (CEPA).

When the country of origin is Korea, exporting to those countries above will result in fewer tariffs. For example, a cotton T-shirt made in China by a Korean brand is not eligible for the FTA in any way if it is exported to the U.S. Conversely, if a cotton T-shirt made from Giorgio Armani was made in India, Korea could receive a tariff benefit when shipped to Korea. India requires around 6% instead of 13% tariffs imposed in terms of normal trade.

Let’s combine foreign brand’s pricing structure, Trading Term, and FTA.

For example, when a shop owner in France purchases items from a brand at a wholesale price of 25 euro excluding tariffs and shipping costs, it depends on the delivery terms (FOB, Ex-work, CIF, FCA, etc.) and delivery company (UPS, TNT, Forwarder, etc.) as well as whether or not the country of origin is subject to FTA. The multiples are changeable as follows.

When an item with a wholesale price of 25 euro is officially cleared to France and flown to a country subject to FTA (FOB), it will have a domestic arrival price (landed cost) of 27.5 euro (10% higher than the wholesale price).

The product flight to a country not subject to FTA has a landed cost of 32.5 euros, which is 30%higher.

As you can see from the table below, the wholesale price of 2.5 times the retail price is

27.5 euros – 62.5 euro: 2.27 multiples

32.5 euros – 62.5 euro: Less than twice as much, 1.9 times.

<PIC>

This is the case when the shop manager (retailer) contacts a brand directly. The distributor with the comprehensive distribution rights in France gets approximately a 25% discounted price from the brand (depending on the order volume, contract period, role, etc.).

Wholesale price: 25 euro

Import from a distributor: 18.75 euro

A retail price: 62.5 euro

Exports on the basis of this pricing structure are

Landed price of the country not subject to FTA: 24.3 euro, a 30% increase from 18.75 euro

Landed price of the country subject to FTA: 20.6 euro, a 10% increase from 18.75 euro

The multiple is

24.3 euro to 62.5 euro: 2.57 multiples

20.6 euro to 62.5 euro: 3.03 multiples

The distributor receives a 25 % discount under the condition of taking responsibility for shipping, managing the market, tariffs, and inspections (in the case of importing products for children under 3 years old). The distributor has given the power to control prices in France. In addition, the distributor is able to resell products to retailers through distribution channels, whether it is consignment sales or purchasing. In the case of purchasing, the fee is doubled while it is 30 to 40% for consignment sales. This structure allows distributors to have the biggest profit margin when they directly distribute the products. In general, prices are often raised from 10% to 30% of RRP depending on the brand.

For instance, goods from countries subject to FTA are:

Wholesale prices designated by the brand (25 euros), actual prices In France (18.75 euros), landed price in France (20.6 euros), wholesale price in France (34.4 euros) and retail price in France (68.75 euros).

In other words, when the product purchased at 18.75 euros arrives in France, it becomes 20.5 euro while 65 euro items are increased to the retail price of 68.75 euro. Half of this price, 34.4 euro, is the price the distributor offers to the domestic retailers. When the distributor has their own sales channel, the distributor will take a large profit margin of 3 multiples and 1.6 times when sold to the middleman.

The pricing structure of the B2B channel has a large spectrum and may depend on the overseas partner’s price strategies.

According to the pricing structure discussed above, the distributor found that the biggest profit margin would be achieved when owning direct sales channels. The next section deals with the pricing of the distributor and their business strategy.

4.Case Study

Lotte Mart and Little Ground in Korea, Intersport in Swiss, Stadium in Sweden and ABC Mart in Japan have something in common. All of these stores are retailing channels with their own brand. These companies sell wholesale items from on/offline, and products from a new or same company name.

For example, ABC Mart launched in 1985 and became a distributor with Japanese distributor rights of Vans in 1991 and Hawkins’ acquisition and created their own brand called Nuovo. The sales of PB brands reached 46.5% in 2014. Selling famous brand products such as Nike, Adidas, Reebok, and Puma has the profit margin of 2 times while selling their own brand products is 5 times. It is a decoy effect to sell their own brand products by displaying them together with high-quality brands.

Another example is a company named Stadium in Sweden. Stadium is a multi-brand store that specializes in sporting goods with over 100 shops in Sweden. Most of the famous brands are sold at Stadium as well as other brands including Warp (street brand), Race Marine (Sports lifestyle brand), SOC (Shoes), Everest (outdoor), Four D (Golf), etc. The business strategy of the multi-brand retailing channel is as follows.

In the early stages of the business, buying many popular brands is important for increasing traffic and generating a stable sales channel. The next step is to sign the Distributorship Agreement for exclusive sales as well as increasing the profit margin. The main brand will be established at this stage and the proportion of existing retailer brands will begin to balance out and import only popular items. In the third phase, launch the PB brand. If your company is unable to make a big investment, target the niche market, such as socks, accessories, slippers, and hair bands. Profit margins through the PB brand can be at least five times larger because the retailing channels are already visible in the market.

In terms of the time line, the volume of the brand should be balanced by increasing the percentage of the PB brand. From phase one to two, the brand volume with distributorship will expand. It is also a phase to focus on more sales with fewer imports from the other brands. When launching a PB brand, the third phase, the ratio of imported items, items with distribution rights, and PB brands should not exceed 5:3:2. It indicates that selling a lot of imported items cannot be compared with the final profit margin of PB brand.

ABC Mart had sales of 46.5% of PB brands in 2014, which would be around 20% based on actual units sold. Moreover, even with 70% off, for example, the size of the PB brand will be 70% and the rest of the import brands will be around 30 to 50%. It is an incentive to increase buyer traffic even with 70% discounts and still cover for manufacturing costs. For these reasons, owning the PB brand is very beneficial.

PB brands began to boom in Korean social commerce; Ticketmonster launched Hers, Textbook for Flavors, Secret for Flavors, Chak, Made, Max & Alice, Bananacrazy, Youcallmeex. Wemaketheprice followed this trend by launching a fashion brand called Red Simple. With the growth of social commerce within the past 5 years (7 times 1 trillion), the prospects of the PB brand is promising.

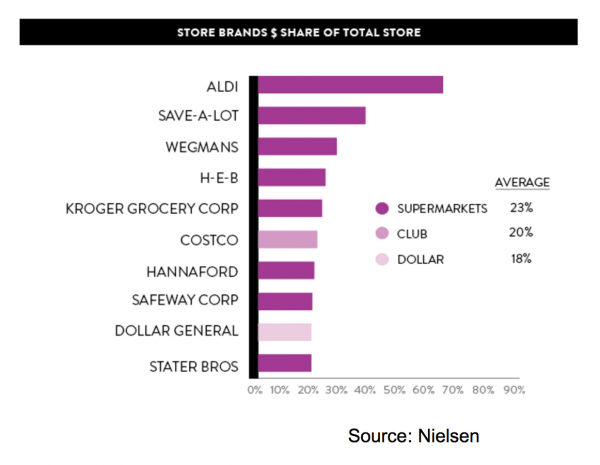

According to a 2014 report by U.S. research organization Nielsen, the sales percentage of PB brands in total sales of $ 643 billion (760 trillion won) reached 17% ($ 112 billion or 132 trillion won).

This report deals with retailing channels, the definition of B2B and B2C, and the difference between B2B and B2C businness in terms of a fashion brand. It also dealt with the structure that the distributor can make the biggest profit margin and B2C structure in the B2B platform by creating PB brand. No matter what sales channel your company chooses, keep in mind that B2B and B2C can also crossover. Focus on the main target to create the best stretagy for your company.

No Comments